Tariffs have long been seen as a tool of trade, used to protect domestic industries from foreign competition. But in recent years, a new group of economic nationalists have emerged, advocating for a different approach to tariffs. They see tariffs not just as a means of trade, but also as a way to reform the tax system and fund the government. And they believe that these tariffs can pave the way for a new era of American prosperity.

This new group of economic nationalists has gained momentum in recent years, fueled by a growing sentiment of American nationalism and a desire to revitalize the country’s economy. They argue that tariffs can serve as a powerful tool to achieve this goal, by creating a more level playing field for American businesses and workers.

One of the main arguments put forth by these economic nationalists is that tariffs can help to reduce the country’s reliance on income and corporate taxes, which they see as burdening the middle and working classes. Instead, they propose a shift towards a system of consumption-based taxes, with tariffs playing a crucial role in generating revenue for the government.

This idea of using tariffs to fund the government is not new. In fact, tariffs have historically been an important source of revenue for the United States, dating back to the country’s early years. However, in recent decades, the focus has shifted towards income and corporate taxes, leaving tariffs to play a secondary role in the country’s tax system.

But with the rise of economic nationalism, there is a renewed interest in using tariffs as a primary source of government funding. Proponents argue that this approach could not only reduce the burden on middle and working-class Americans, but also incentivize domestic production and encourage businesses to bring jobs back to the United States.

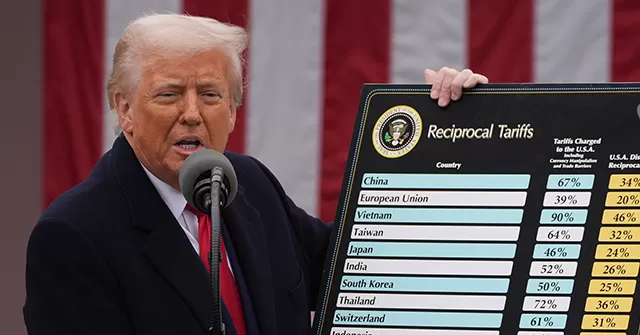

One of the key figures leading the charge for this tariff-based tax system is President Donald Trump. During his 2016 campaign, he promised to renegotiate trade deals and impose tariffs on countries that he believed were taking advantage of the United States. Since taking office, he has followed through on these promises, imposing tariffs on a wide range of goods from countries such as China, Mexico, and Canada.

Critics argue that these tariffs could lead to a trade war and harm the economy. However, supporters of this new approach see it as a necessary step towards rebalancing the global trade system and protecting American interests.

They point to the success of countries like Singapore and Switzerland, which have used tariffs and consumption-based taxes to fund their governments and achieve economic prosperity. They argue that the United States can do the same and become a global leader in this regard.

Moreover, the use of tariffs as a means of tax reform is not limited to just the federal level. Some states, such as South Dakota and Wyoming, have already implemented tariffs as a way to fund their state governments and reduce the burden on their citizens.

In addition to the economic benefits, supporters of this approach also see it as a way to promote American values and protect national security. By reducing reliance on imports and promoting domestic production, they believe that the country can become more self-sufficient and less vulnerable to the whims of other nations.

Furthermore, tariffs can be targeted towards specific industries or products that are deemed essential for national security, such as steel and aluminum. This ensures that these industries are protected and maintained, preventing the United States from becoming overly dependent on foreign countries for essential goods.

In conclusion, tariffs are no longer just a tool of trade, but an instrument of tax reform and a means to ensure American prosperity. This new generation of economic nationalists sees tariffs as a way to reduce the burden on middle and working-class Americans, incentivize domestic production, and protect national security. And with the current administration’s focus on renegotiating trade deals and imposing tariffs, it seems that these ideas are gaining traction and could potentially shape the future of American economic policy.

![Complete BritRail Pass Guide [Types, How to Use It, Pros + Cons]](https://inside-news.uk/wp-content/uploads/2025/06/00221EB4-BCA2-4DBB-6CD4-83DBC37D71FA-120x86.webp)